Ever wondered how you can invest in real estate without buying a whole property? Real estate crowdfunding is changing the investment game by letting you pool your money with others to fund real estate projects. It’s a straightforward way to diversify your portfolio, even if you don’t have thousands to invest. In this post, you’ll learn the basics of how does real estate crowdfunding work? And why it might be a smart move for your financial future.

What is Real Estate Crowdfunding and How Does Real Estate Crowdfunding Work?

Real estate crowdfunding is a process where a group of investors come together to fund real estate ventures. Similar to the way you might chip in with friends to buy a gift, investors pool their money online to purchase or finance a property. This collective approach allows individuals to become partial owners of different properties, ranging from residential buildings to commercial spaces. According to Investopedia, this method democratizes the real estate market, enabling those with less capital to gain investment exposure.

The Mechanics of Real Estate Crowdfunding

Finding the Right Platform

To start investing through crowdfunding, you’ll need to choose a platform that suits your financial goals and risk tolerance. Various platforms offer different types of investments, with some catering to beginners and others requiring investors to be accredited. Platforms like Fundrise and RealtyMogul are renowned for offering a diverse range of opportunities.

Investment Process

Once your platform is selected, the investment process typically involves:

- Sign-up: Create an account on the platform of your choice.

- Browse Listings: Search available real estate projects based on your preferences, such as location, type, and projected returns.

- Investment Decision: Choose a project and invest the amount you’re comfortable with.

- Monitor Performance: Track the performance of your investments through the platform dashboard.

This process is straightforward, often requiring only an internet connection and a few clicks of a mouse, as noted by Propstream.

Pros and Cons of Real Estate Crowdfunding

Advantages

- Diversification: Crowdfunding allows investors to diversify their portfolios by spreading funds across various properties and locations.

- Lower Barriers to Entry: You don’t need large sums of money to start investing; even small amounts are welcomed on many platforms.

- Passive Income: Investors can earn regular income through rental returns and potential appreciation without managing the properties themselves.

Drawbacks

- Risk: Like any investment, there’s inherent risk involved. Market fluctuations and project-specific risks can affect returns.

- Liquidity Issues: Unlike stocks or bonds, real estate investments are not easily liquidated, which means your investment could be tied up for several years.

The Ultimate Guide to Real Estate Crowdfunding offers a comprehensive look at these pros and cons.

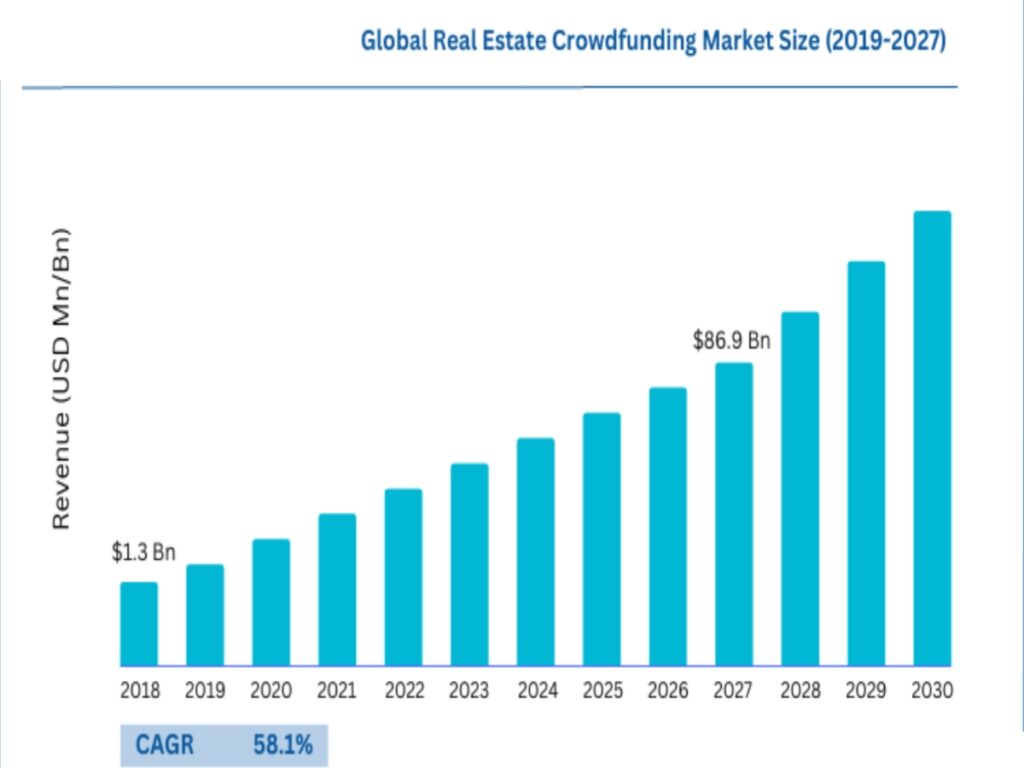

Trends in Real Estate Crowdfunding

In recent years, we’ve seen real estate crowdfunding platforms carving a significant niche within the investment landscape. Current trends point towards a growing interest in sustainable and residential developments, partly due to increasing urbanization. The market is continually evolving, presenting myriad opportunities and challenges for investors.

With platforms like Fundrise and others optimizing their services, there’s an exciting buzz surrounding the constantly changing scene. The RealtyPlus has further insights into these advancements.

Is Real Estate Crowdfunding Right for You?

Investing in real estate through crowdfunding can be a great way to enter the market without immense financial backing. However, it’s essential to weigh the potential rewards against the risks and consider whether your investment strategy aligns with crowdfunding’s unique attributes.

Are you ready to dive into the world of property investing without the traditional headaches? Real estate crowdfunding might just be the gateway to your investing journey.

Conclusion

Real estate crowdfunding has revolutionized the way we think about property investment. By pooling resources, individual investors can now access opportunities once reserved for big players. As with any investment decision, due diligence, research, and aligning with personal financial goals are key. Whether you’re a beginner or a seasoned investor, this method offers something new and promising in the evolving real estate investment scene.

For those looking to explore further, platforms like Rocket Mortgage offer additional insights on how you can leverage technology to diversify your investment portfolio.

You may like these: