Real estate crowdfunding is booming in Germany, offering a modern way to dip your toes into property investment without hefty price tags. But what makes this niche so appealing? Let’s dive into the details that make real estate crowdfunding a compelling choice for both new and seasoned investors.

Photo by Pixabay

Photo by Pixabay

What is Real Estate Crowdfunding?

Imagine pooling your resources with a bunch of other interested folks to buy a slice of the real estate pie. That’s essentially what real estate crowdfunding is. It’s a collective investment strategy where multiple people contribute to funding real estate projects, sharing both the risks and rewards.

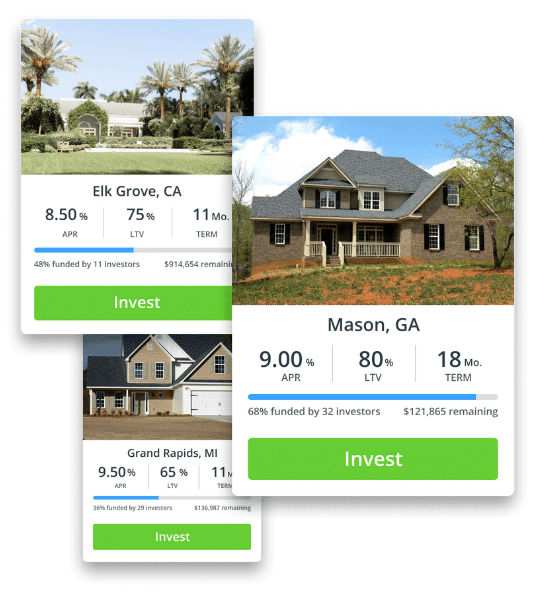

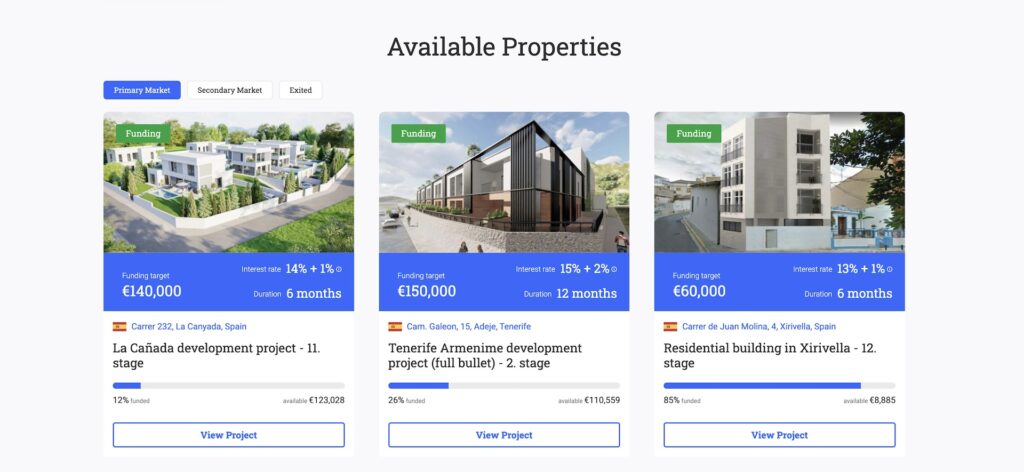

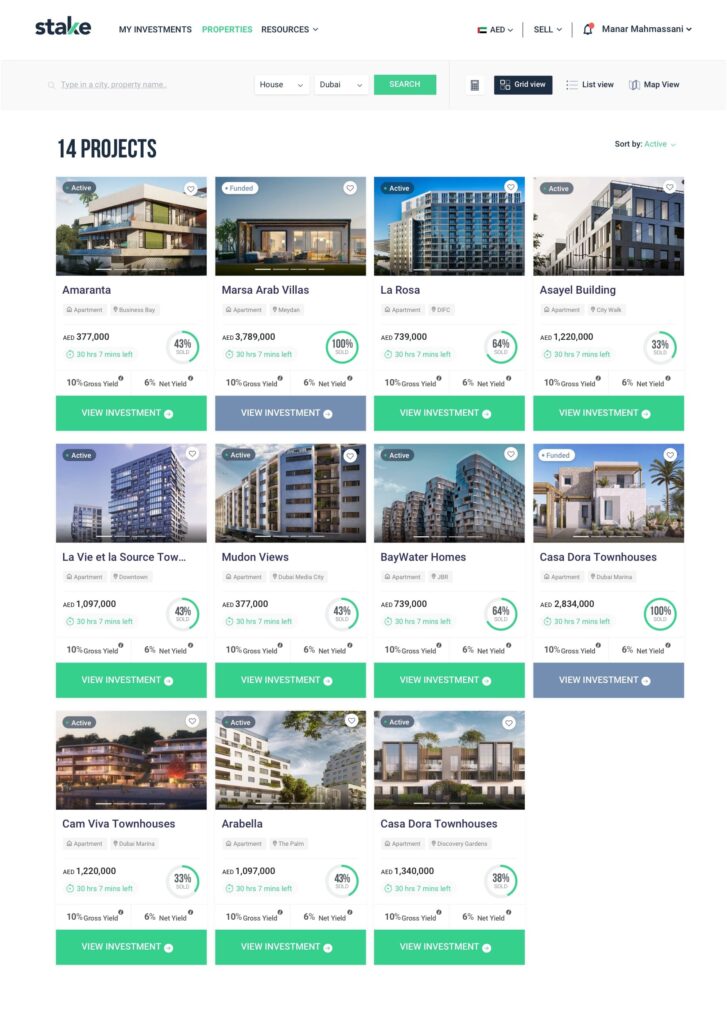

The crowdfunding landscape in Germany offers equity, debt, or P2P lending investment opportunities. These methods have democratized real estate, making it accessible not just to big-time investors but to anyone with an interest and a bit of cash.

Table of Contents

Why Choose Real Estate Crowdfunding in Germany?

Germany’s stable economy and robust property market create an ideal backdrop for real estate investments. With the German legal framework allowing real estate crowdfunding, investors can engage securely in this burgeoning field.

Accessibility and Flexibility

You don’t need a king’s ransom to start. Platforms usually require smaller sums compared to traditional real estate investments, broadening participation. Whether you’re investing in Berlin’s bustling market or countryside charms, crowdfunding platforms provide the flexibility of choice.

Top Real Estate Crowdfunding Platforms in Germany

Germany’s real estate crowdfunding scene isn’t just thriving—it’s booming! Some of the top platforms include:

- Exporo: Known for its transparency and user-friendly interface, Exporo ranks as one of the most popular platforms. It offers a variety of real estate projects that cater to diverse investor appetites.

- Zinsland: While they halted new projects, Zinsland remains a noteworthy entity in guiding investors through German real estate markets.

- Rendity: Though primarily focusing on Austria, it offers significant real estate investment opportunities in Germany.

For a more comprehensive list, check out the directory of crowdfunding platforms in Germany.

Benefits and Considerations

Engaging in real estate crowdfunding comes with enticing benefits. Investments are fuss-free and often more engaging than navigating the intricacies of traditional buying. Plus, the low entry costs mean you’re not breaking the bank to get in on the action.

However, it’s crucial to have an eye out for potential pitfalls. While you might not deal directly with tenants, understanding the market is essential. Keeping up with emerging trends and regulations can save you headaches down the road.

The Future of Real Estate Crowdfunding in Germany

What’s next for real estate crowdfunding? It’s likely to keep growing as more people get comfortable with digital investing platforms. As technology evolves, many predict an increasingly interactive and intuitive investment experience.

In a world where adaptability reigns supreme, real estate crowdfunding offers a refreshing twist on traditional investing. Will you take the leap and join this exciting venture?

Conclusion: Ready to Invest?

Germany’s real estate crowdfunding offers a viable and exciting path to enter the property market without the usual barriers. With a plethora of platforms and a supportive legal environment, there’s never been a better time to explore this innovative investment method. Whether you’re an aspiring investor or a seasoned pro, it’s time to consider how this avenue might fit into your financial journey. Ready to make a move?

You may like these:

How to Open a Demo Forex Trading Account: Step-by-Step Guide

Real Estate Crowdfunding International: Trends and Opportunities

How to Make Money Food Blogging: Your Complete Guide

How do I make money with Google Adsense?

FAQ: Real Estate Crowdfunding Germany: A Modern Investment Frontier

1. What is real estate crowdfunding in Germany?

Real estate crowdfunding in Germany is a method that allows multiple investors to pool their funds to finance real estate projects, providing access to the property market for smaller investors.

2. How does real estate crowdfunding work in Germany?

Investors contribute small amounts of capital through online platforms, which then aggregate these funds to invest in specific real estate projects, allowing for fractional ownership.

3. What are the benefits of real estate crowdfunding in Germany?

Benefits include lower investment thresholds, diversification of investment portfolios, access to professional management, and the potential for attractive returns.

4. What risks are associated with real estate crowdfunding in Germany?

Risks may include market volatility, project delays, illiquidity of investments, and the possibility of losing the entire investment if a project fails.

5. How can I choose a reputable real estate crowdfunding platform in Germany?

Look for platforms with transparent fees, clear project details, positive user reviews, regulatory compliance, and a track record of successful investments.

6. What types of real estate projects are available for crowdfunding in Germany?

Projects can range from residential developments and commercial properties to renovations and land acquisitions, catering to different investment strategies.

7. Are there regulations governing real estate crowdfunding in Germany?

Yes, real estate crowdfunding in Germany is regulated under the Capital Investment Act, ensuring investor protection and promoting transparency in crowdfunding activities.

8. Can non-German residents invest in real estate crowdfunding in Germany?

Yes, non-German residents can invest in real estate crowdfunding in Germany, depending on the platform’s terms and conditions, as well as their home country’s regulations.

9. What is the minimum investment amount for real estate crowdfunding in Germany?

The minimum investment amount varies by platform, but it can start as low as €500, making it accessible for a broader range of investors.

10. How are returns calculated in real estate crowdfunding projects in Germany?

Returns are typically calculated based on rental income, property appreciation, and profit sharing from project sales, which vary depending on the project’s performance.